In an era demanding faster and more efficient cross-border financial transactions, XRP is once again at the forefront of innovation with its latest technical update. The blockchain community and financial institutions around the world are in excitement and curiosity following XRP’s announcement of a new transaction validation protocol. This development promises to revolutionize the way cross-border payments are managed, reducing both time and costs significantly.

Today’s world is deeply interconnected, with global trade and investment flows fueling demand for frictionless financial interactions. Legacy systems, often slow and expensive, have long been a point of contention among financial professionals. XRP’s new protocol arrives as a beacon of hope, suggesting that cross-border transactions could soon be executed almost instantly.

What makes this new protocol unique? Instead of relying on proof of work or similar consensus mechanisms, the upgrade introduces a decentralized agreement approach. This method ensures that transactions are not only faster, but also more secure and less energy intensive. As financial institutions test this promising protocol, early reports suggest a potential reduction in transaction costs of up to 90%.

Looking ahead, the implications of the XRP upgrade are profound. If successfully adopted, it could trigger a large-scale transformation in global finance, making real-time cross-border transactions a new global standard. As institutions continue to adapt and integrate this revolutionary technology, it is clear that XRP is not only remaining relevant, but actively shaping the future of digital payments.

Future of Cryptocurrency Investing: What to Expect by 2025

In the ever-changing world of cryptocurrencies, investors are constantly seeking information and predictions to make informed decisions. As we look toward 2025, the digital asset landscape, including major players like XRP, is expected to undergo substantial transformations. Here’s a focused analysis of what investors should anticipate in terms of cryptocurrency rate predictions, investment risks, pros and cons, and ongoing controversies.

Cryptocurrency rate forecasts for 2025

Cryptocurrency market analysts predict a mixed but promising future for digital currencies. By 2025, many experts predict that the adoption of cryptocurrencies could lead to price stabilization. For XRP, in particular, recent technological advances could be a driver of its valuation. With successful institutional integration, XRP could see a significant increase in value, potentially doubling or tripling from its current rates. The focus on faster, lower-cost cross-border transactions adds a fundamental value proposition that can attract both retail and institutional investors.

Investment risks

Despite the optimistic outlook, potential investors should remain cautious. The cryptocurrency market is notorious for its volatility, and even well-established currencies like XRP are not immune. Regulatory responses, particularly regarding XRP’s ongoing legal struggles over its classification as a security, add layers of uncertainty. Therefore, investors should prepare for sharp market swings and consider diversification to mitigate risks.

Advantages and disadvantages of investing in cryptocurrencies

Benefits :

1. High return potential: Cryptocurrencies, with their rapid growth and adoption, offer opportunities for significant investment returns.

-2. Technological innovation: Coins like XRP are at the forefront of the payments revolution, making them attractive for their utility and innovation in financial services.

3. Diversification : Adding cryptocurrencies can enhance traditional portfolios by introducing new asset classes.

Disadvantages:

1. Volatility: Extreme price fluctuations can result in substantial financial losses.

2. Regulatory risks: Legislative uncertainties can impact market stability and investor confidence.

3. Safety Concerns: Although blockchain technology is secure, investor accounts and exchanges can still be vulnerable to hacks.

Ongoing controversies

XRP has come under increased scrutiny due to its legal issues surrounding security classifications, which continue to be a topic of debate within the cryptocurrency community. These controversies influence market perceptions and could lead to regulatory changes, impacting its pricing and adoption rates. The outcome of these legal challenges could set a precedent, shaping the rules of engagement for other digital assets.

For more information on the rapidly evolving cryptocurrency market, visit the main domain of CoinDesk, a trusted Source for news and analysis.

As digital currencies continue to challenge traditional financial systems, understanding their complexities and implications is essential for potential investors. With careful research and strategic approaches, navigating the uncertain but opportunity-rich terrain of cryptocurrencies between now and 2025 could prove rewarding.

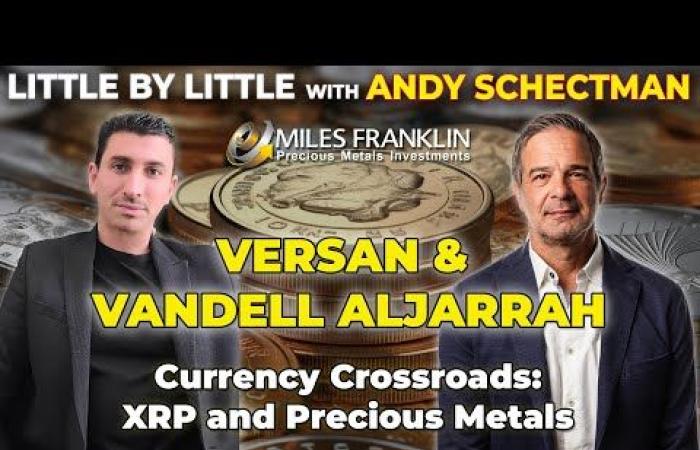

Currency Crossroads: XRP and Precious Metals with Versan & Vandell Aljarrah (Little By Little)